How to Review, Accept and Sign the Annual Report of Your Estonian Company

The annual report, sometimes also called the annual activities report, annual financial report, or annual fiscal report, is a document that all companies need to submit to the tax authorities, as specified by article 60 of the Estonian commercial code. It is mandatory even if your company did not have any activity at all, and must be written in Estonian, and using the euro as the currency of reference.

Writing the annual report, even if you know Estonian, can be a daunting task. It may usually require extensive knowledge about accounting matters. However, if you are a Companio customer, we can assist you in preparing and submitting the annual report without stress.

However, when the report is ready, we need you to review it, and sign it. Only a member of the board can approve the final report before being submitted, and you need to digitally sign it.

When creating the report, we may ask you some questions to understand your activities better, or to inquiry about your intentions to distribute profit, or to solve a negative balance situation. It is also a good idea to download the report before signing it, translate it using an automated tool at least, and understand everything before signing it.

In this article, we explain how to review, accept, and sign the annual report of your Estonian company.

Table of contents

- Preparations

- Profit or loss?

- Accessing the Company Registration Portal

- Approving and signing the report

- Step 1: Compiling a report

- Step 2: Reviewing a report

- Step 3: Signing a report

- Step 4: Submission of a report

- Proposal for profit distribution or covering of loss

- Distributing the profit accordingly

- Share capital reserve

- Dividends?

- Repeating the process for the profit distribution resolution

- Report submitted

Preparations

Later in the annual report confirmation process, you will need to have a look at the Articles of Association to look for certain clause. Don’t worry, we will explain everything later in the appropriate step, but it is convenient to download the Articles Of Association if you don’t have them handy right now.

To do so, please proceed as specified in the following tutorial.

We also recommend that you log in to the Company Registration Portal with your e-Resident card, and check if you must assign the beneficial owners of the company. If, upon entering, you see a notice that says “Beneficiary owners not appointed”, before following this tutorial it is important that you designate them by following these instructions.

Profit or loss?

When preparing the annual report, we will contact you to make sure all the information is correct. There may be two possibilities. Ideally, your company will have a positive profit for that financial year, meaning, your revenue surpassed your expenditure.

If that is not the case, there may be a potential bankruptcy situation that needs to be solved. In this faq, we explain some of the reasons why this may happen, and the options available to the members of the company to avoid that scenario and get back into a regular financial status.

Accessing the Company Registration Portal

Once we have written your annual report, we will prepare its submission. Then, you need to review, accept and sign it to be submitted to the tax authorities.

Let’s see how that works.

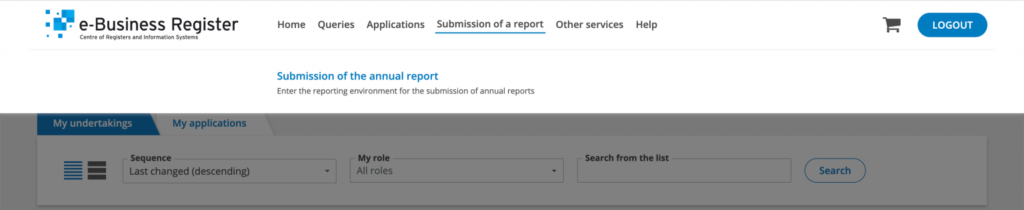

First, log into the Company Registration Portal using your e-Residency card. Then, click on “Submission of a report > Submission of the annual report” on the top.

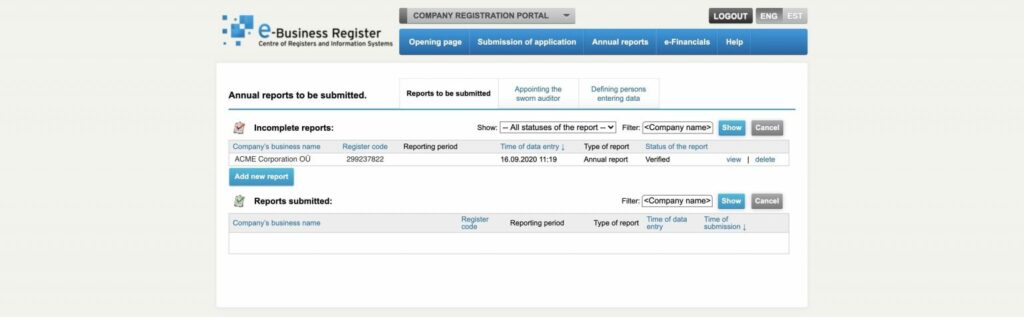

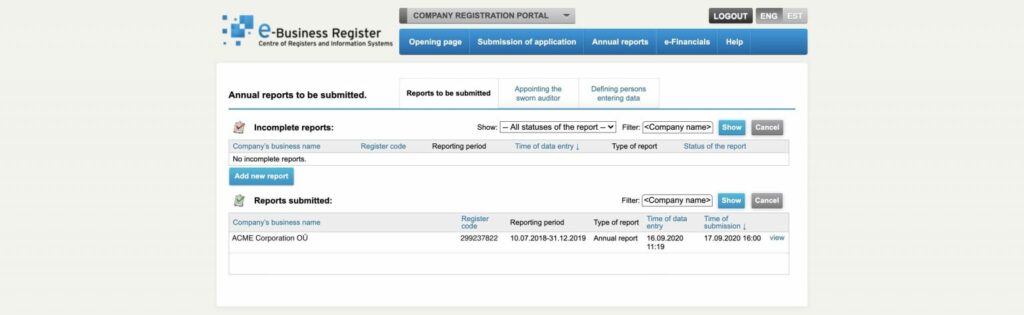

Then you will see the report in the list of “Annual reports to be submitted” under “Incomplete reports”.

Then, next to the incomplete report, you will see two options at the right: view and delete. Click on the view button.

Approving and signing the report

Approving and signing the report is usually a four step process. There are many variations depending of your company’s activity and its profit or loss during the financial period, but don’t worry, we will try to cover every possible option you need to consider. As always, you can always ask us for help.

Step 1: Compiling a report

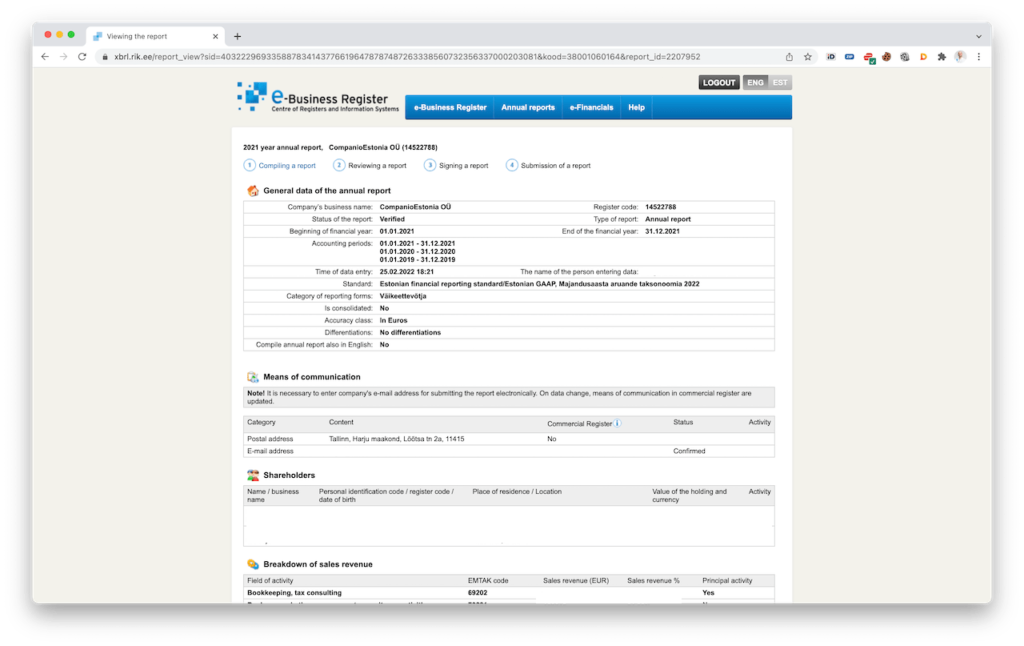

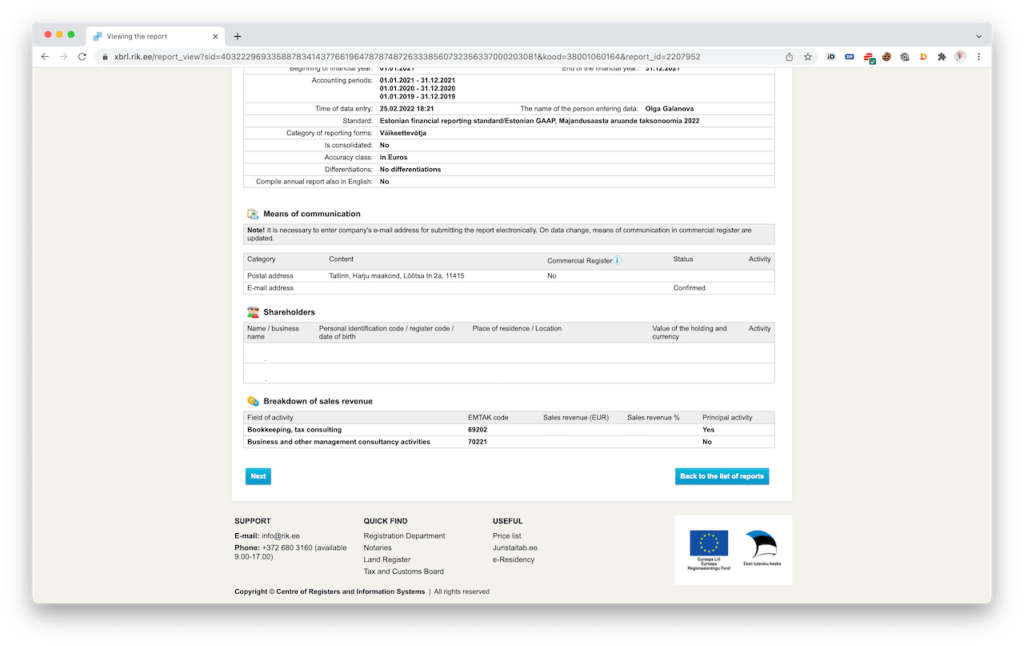

In the first step, you will see a summary of the general data of the annual report, but not the report itself.

Click on the “Next” button at the bottom of the page to go to the next step, “Reviewing a report”.

Step 2: Reviewing a report

Now, in step 2, you can actually access and verify the annual report. There seem to be many options, but you only need to do a couple of things.

First, download and review the annual report (PDF document) in English. If the English version is not available, only the Estonian PDF, you can download and translate it to English using a service such as Google Translate. Usually, the English version will be available.

Have a look at the annual report. It is important that you understand and agree with its contents. If you have any doubt, please let us know. Later, when you digitally sign this annual report, you are agreeing on the veracity and correctness of its contents.

If you agree with everything, click on the button to go to the next stage “Signing a report”.

Now, to go to the next step, click on “Send the report to signing”.

Step 3: Signing a report

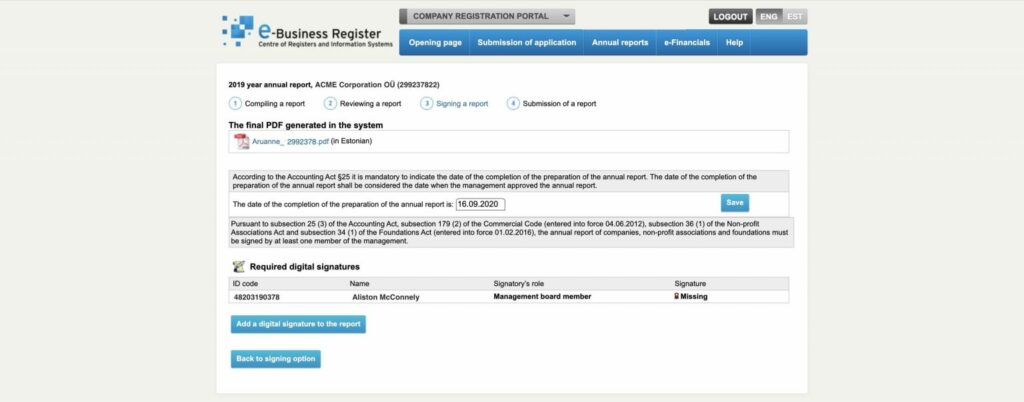

In the third step, you will see a screen with the report in PDF and the missing signatures of the board members who can sign the report. Only one signature from a board member is required, not every member of the board needs to sign.

First, if there is no date specified in the field “The date of the completion of the preparation of the annual report”, add the current date and click on “Save” at the right. Otherwise, you can ignore this change.

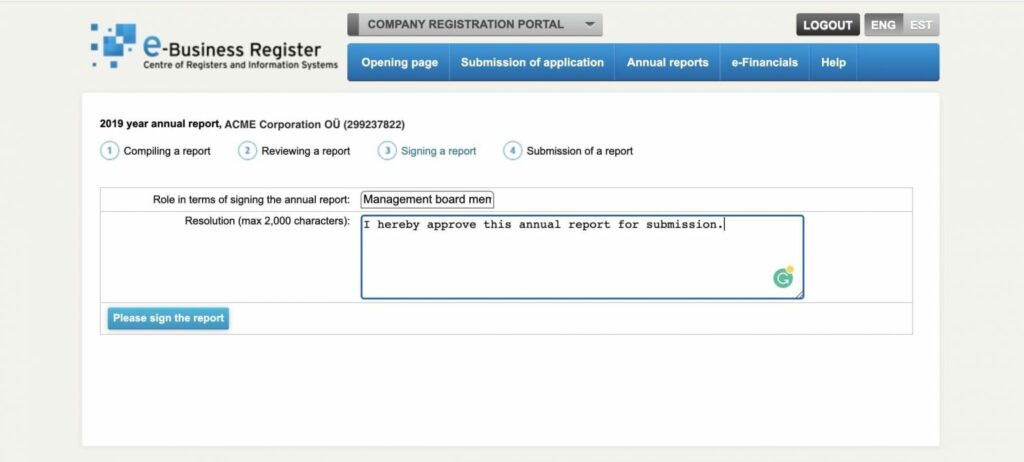

Then, click on “Add a digital signature to the report” if you are happy with it. Before being asked for your digital signature and PIN2, you will be asked to enter a resolution about this annual report. Something as simple as “I hereby approve this annual report for submission” will do.

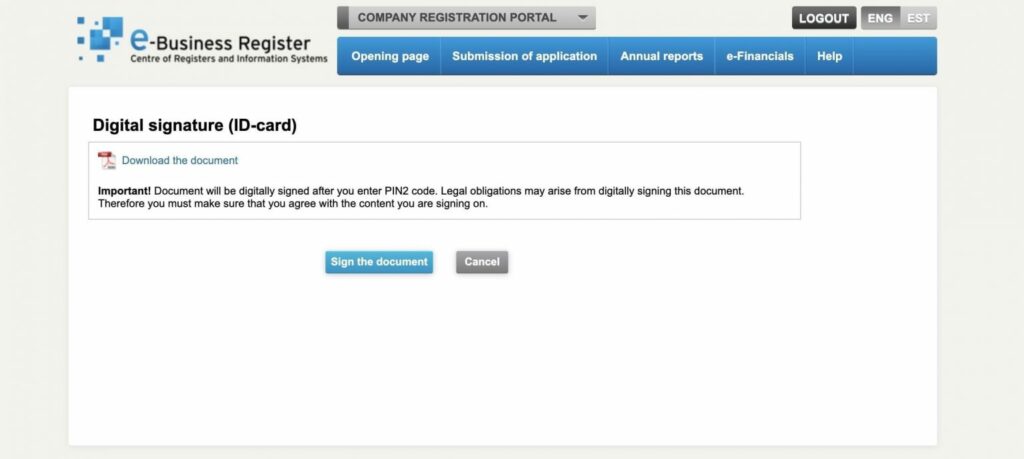

Once you click on “Please sign the report” you will be taken to the screen where they ask for your signature. Just click on “Sign the document”.

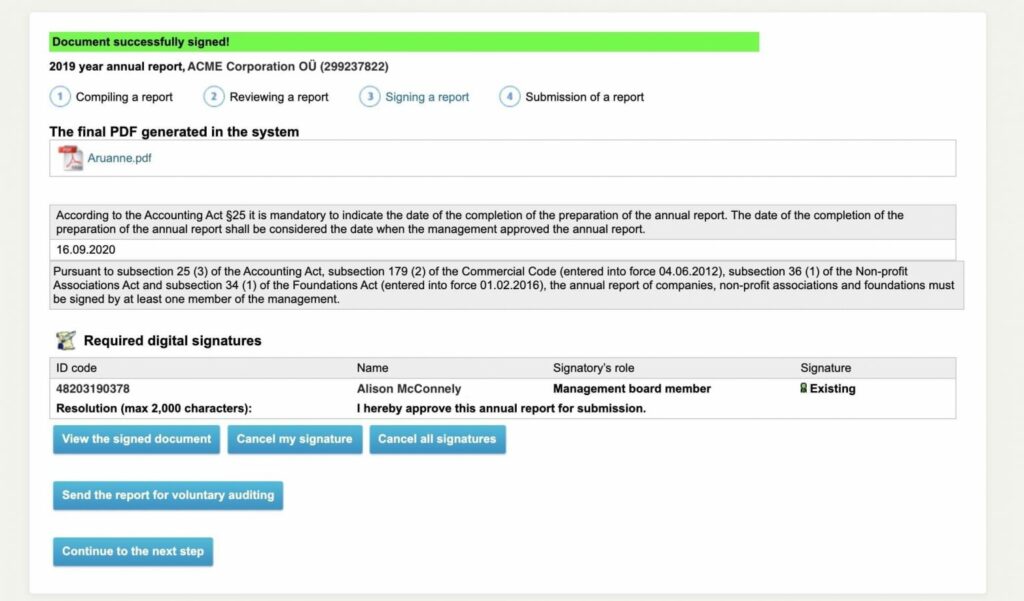

If everything goes well, you will be shown a “Document successfully signed!” message. However, you still need to do one final step, deciding what to do with the profit of the company.

Let’s see how in the next section, click on “Continue to the next step”.

Step 4: Submission of a report

This is a very important step, and it is something that requires the active decision of the shareholders of the company. You need to decide what to do with the profit of the company: reinvest it in the company, or distribute all or part of it. We will also talk about one important clause you must check called the “Share capital reserve”.

Proposal for profit distribution or covering of loss

Before you can submit the report, there is one important decision you need to make: what to do with the profit of the company.

As we mentioned above, of the two possible scenarios of your company, you want to avoid reporting losses. If your company is in that situation, we will contact you to help you fix the situation before proceeding with the report. That leaves only one desirable scenario: profit.

So when your company reports profits, you need to decide what you are going to do with that money.

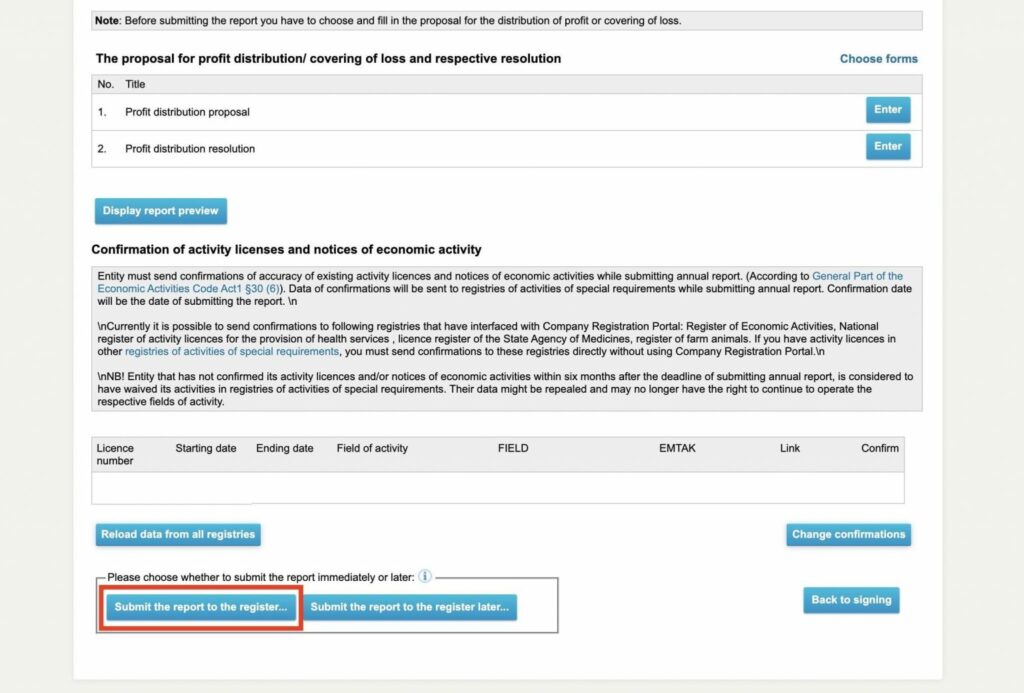

There are two possibilities here: some people may only see the profit distribution option but not the profit resolution. Or you may see both. In some exceptional cases, you will see a proposal for covering losses, but as we mentioned, we will try to avoid that scenario.

If you see loss proposal options, don’t click on them please. Just let us know.

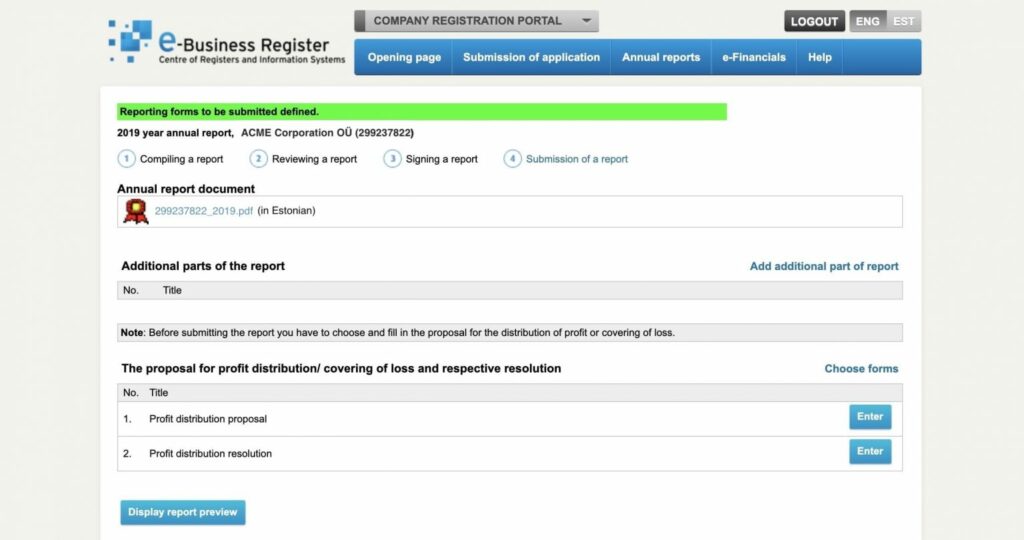

If you see both options, like the picture shows, you need to click on both “Profit distribution proposal” and “Profit distribution resolution”. DO NOT click on any of the losses (resolution or proposal) in case there’s an option for that.

Most probably will see something like this.

You need to click, on the “Enter” button of the “Profit distribution proposal” option.

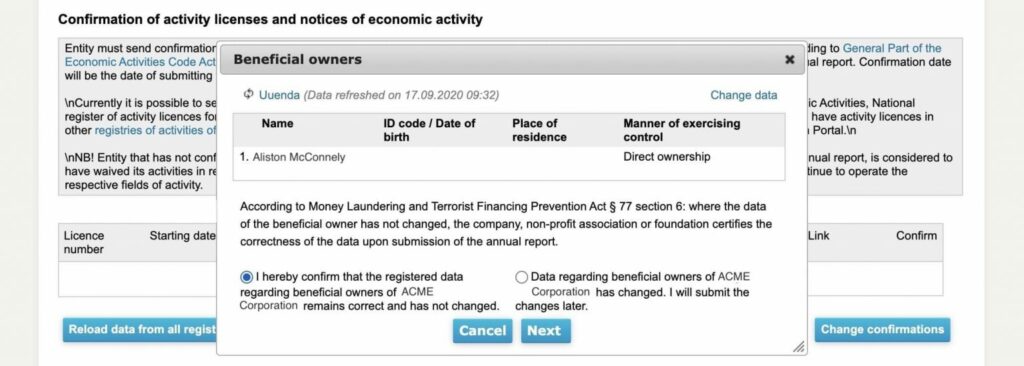

It is possible that you see a message like this:

This is just to make sure that the data of the members of the company has not changed. If the data has changed, you can choose “Data regarding beneficial owners of … has changed. I will submit the changes later”. Otherwise, select the option “I hereby confirm that the registered data regarding beneficial owners of …”, and click on “Next”.

Distributing the profit accordingly

Now, you need to specify what to do with the profit of the previous year. There is a lot of options here, but we will just talk about the most common ones, the options that 99% of people will probably need. With the exception of the share capital reserve, you just need to decide if you are going to distribute dividends or not.

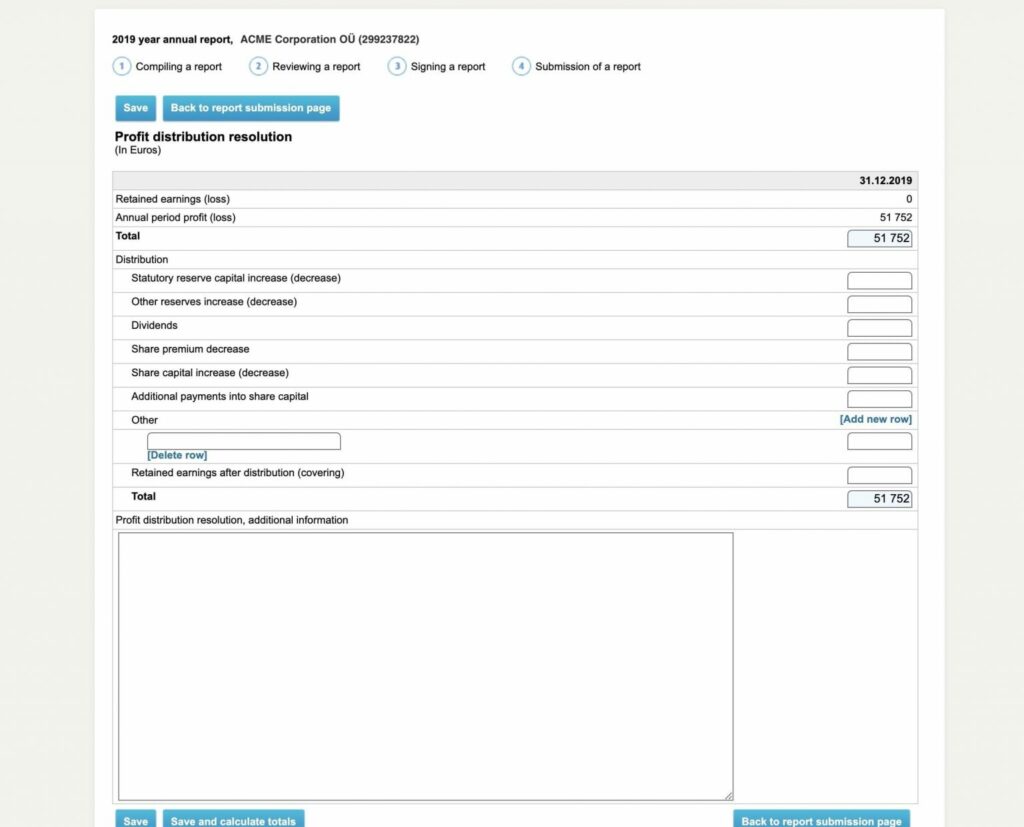

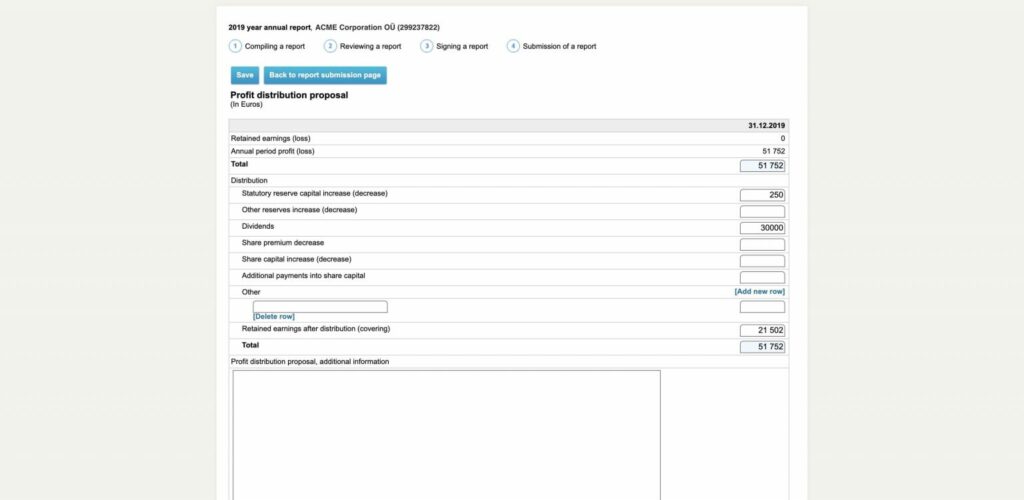

When clicking on “Enter” under “Profit distribution proposal”, you will see something like this.

Looks scary, isn’t it? But don’t worry! You just need to fill in two or three numbers at most, and we will explain them. It is very simple.

On top, you have the total profit of your company for that year. Then, you need to distribute that profit in some fields below, so the “Total” field at the bottom equals the sum of the previous ones. You usually will write just one number, sometimes two or three tops. If the “Total” field is empty, simply copy and paste the amount in the field on top, “Annual report profit (loss)”.

Share capital reserve

Some companies have in their Articles of Association that they will increase the share capital by 10% with the profits of the company. That’s called the “Share capital reserve”. To know if that is the case of your company, look in your articles of association for a clause like this one:

2.5 Osaühingul on reservkapital ja selle suurus on 10% osakapitali suurusest.

It is very easy to locate this clause in your Articles of Association if you look for the word “reservkapital” in the PDF (or “reserve” if it is in English). If you don’t have your Articles of Association handy, you can always download them from the registry.

If that clause is there, you are expected to increase this share capital reserve in the case of profit. You can do this in parts, increasing it a little bit with every annual report, but our recommendation, if you had profit, and the profit of the company exceeded 10% of the share capital, is that you increase this share capital. It only needs to be done once.

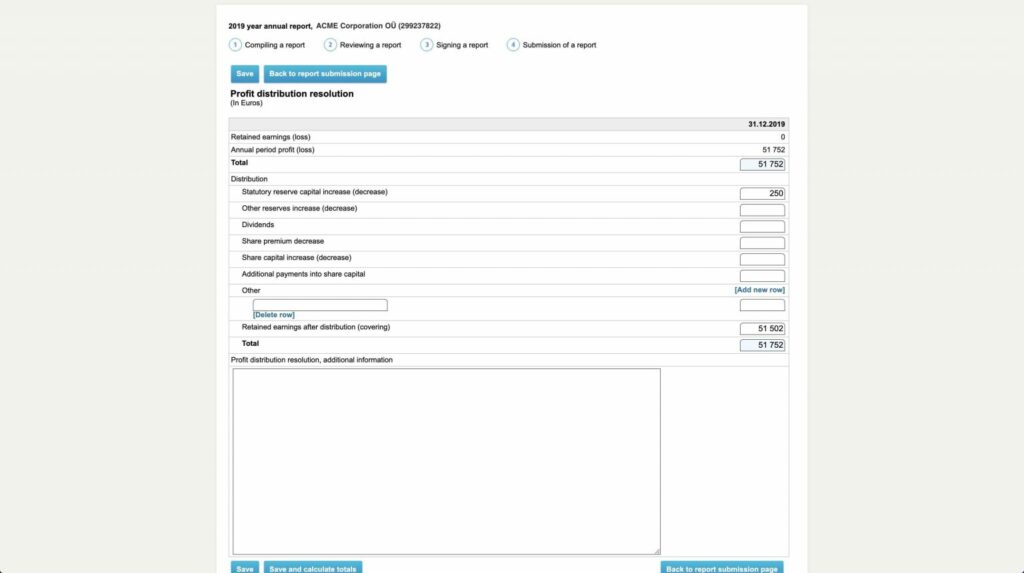

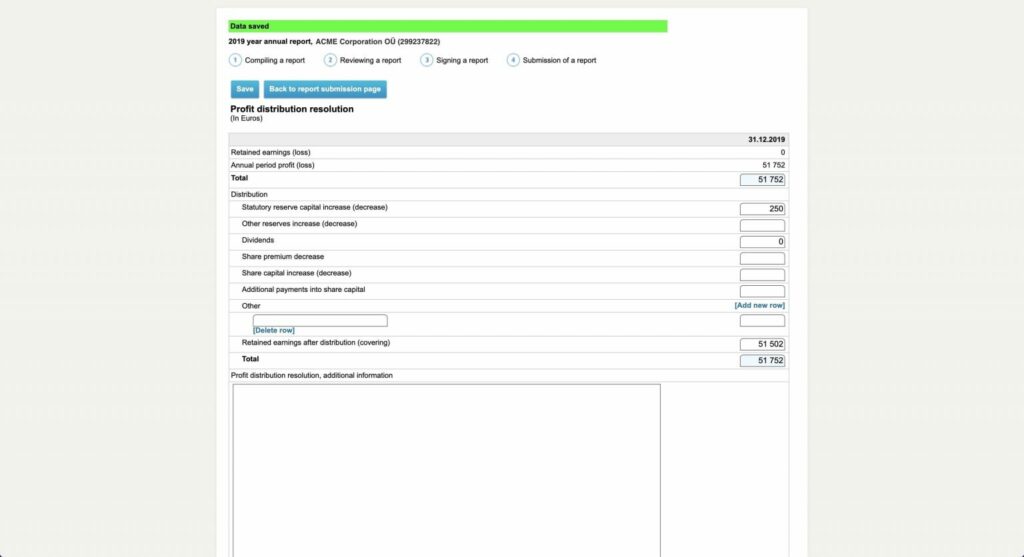

so if you have that clause, and your share capital is 2500€, 10% of that is 250, so write that amount of money in the field “Statutory reserve capital increase (decrease)”, like in the image below.

The field “Retained earnings after distribution (covering)” is the final money that will stay in the company after the distribution, so subtract 250 from the total and write the number left in that field.

For example, if your total is 51,752€, and your share capital was 250€, you will write 250 in the “Statutory reserve capital increase (decrease)” field, and the rest, 51,502€ (51,752€ – 250€) in the field “Retained earnings after distribution (covering)”. The result should look like this:

Dividends?

Apart from that, you just need to decide if you are going to distribute dividends. You will put that amount in the “Dividends” field. If you are NOT going to distribute dividends, you just write “0” like the image below shows:

That means that 250 are used to increase the share capital reserve, no money is distributed as dividends, and the rest, 51,502€ is left in the company.

But what if you want to distribute dividends?

In that case, you write the amount in “Dividends” and subtract that amount from the “Retained earnings after distribution (covering)”. So imagine that you decide to distribute 30,000 euros in dividends, then the retained earnings will be 21,502€ (51,502€ – 30,000€)

That’s basically all you need to do! Make sure the total amount is the exact sum of those three concepts (or two if you did not have a share capital reserve), click on “Save”, and on “Back to the report submission page”.

Repeating the process for the profit distribution resolution

If your company only saw a profit proposal and a loss proposal, this step does not apply to you and you can ignore it. However, if your company saw not only the proposals, but also the profit and loss resolutions, you must to repeat the exact same procedure, specifying the exact same numbers, for the second entry, “Profit distribution resolution”. Enter the same numbers you specified for the previous one.

Once you have finished, click on “Submit the report to the register”.

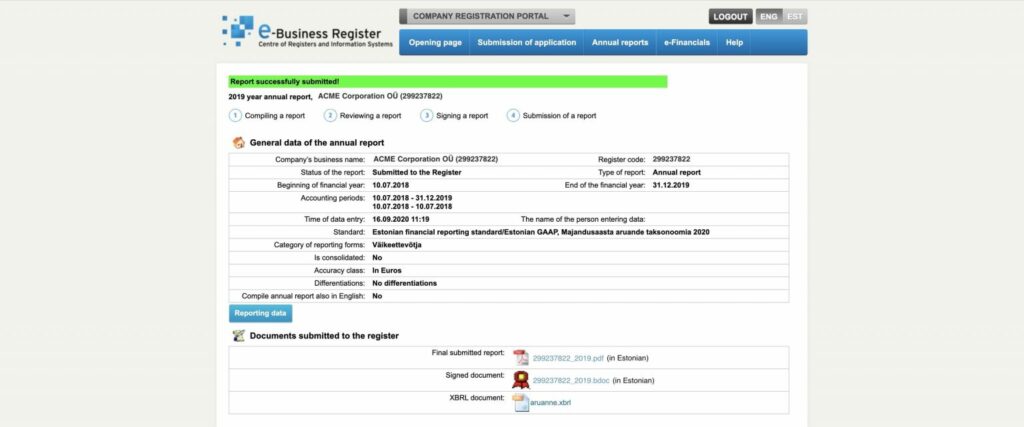

Report submitted

That’s all! The report will be uploaded to the register and, in case you declared dividends, you can now pay them to the shareholders.

Now if you get back to the list of annual reports, you will see the report under the “Reports submitted” list.

Companio provides thousands of clients with high-quality accountancy services, annual report preparation, and trustworthy advice regarding your company in Estonia. With zero hidden fees and unbelievable customer service in multiple languages, we remove the stress and obstacles so you can focus on growing your business.

Ignacio Nieto

Ignacio Nieto