Why You Shouldn’t Use Stripe’s Payment Links Tool: Here’s What You Need to Know

Stripe is one of the most well-known payment solutions available, and at Companio, we rely on it for collecting payments securely and compliantly. However, no payment gateway is perfect, and Stripe is no exception.

In this post, we’ll explain why you should avoid using Stripe’s Payment Links tool, particularly when it comes to handling VAT, and why it could create issues for your business.

Issues with Understanding EU VAT Regulations

In our experience, some American companies, including Stripe, struggle to fully grasp the intricacies of EU VAT regulations. Configuring VAT correctly on Stripe, especially using its Tax Automation feature, involves a series of non-trivial and often confusing settings.

Most of our customers have had difficulty correctly setting up their Stripe accounts to collect VAT. This leads to problems later when they try to use Stripe for generating payment links or issuing invoices.

As a result—especially when issuing invoices—we recommend avoiding Stripe for this purpose. There’s a high likelihood that your invoices could be issued incorrectly, which may cause problems when doing your accounting or, worse, with the tax authorities. Instead, we recommend you to use our invoicing tool.

The Issue with Stripe’s Payment Links Tool

The core problem with Stripe’s Payment Links tool is that it mishandles VAT, especially when dealing with international customers. Specifically, the tool has been known to add VAT when it shouldn’t, and fail to add VAT when it’s required.

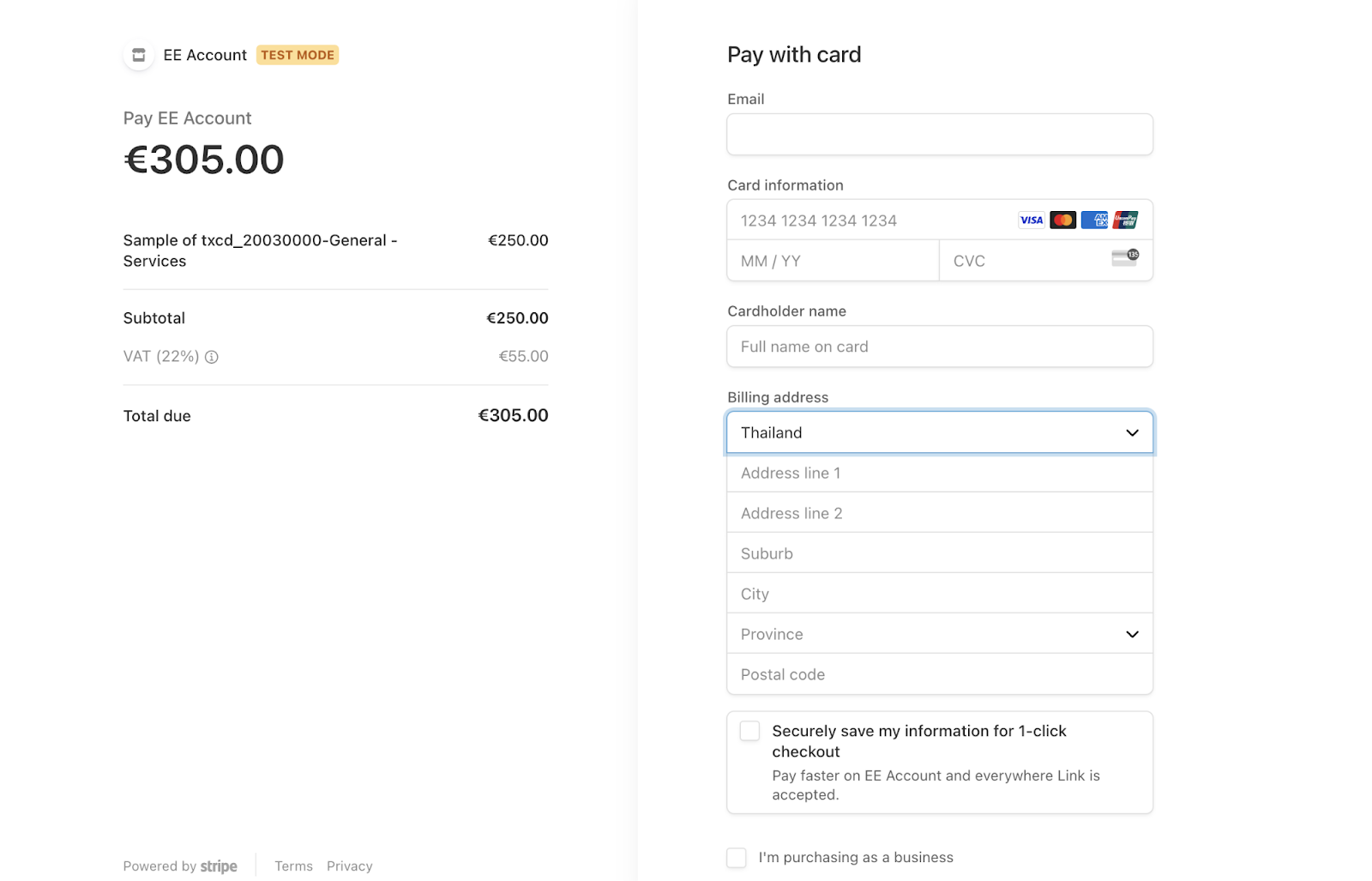

For example, when testing how Payment Links worked on Stripe, we noticed VAT was being added to an invoice for a customer in Thailand. This is problematic because, regardless of the product or service being sold, VAT should never be added to an invoice for a customer outside the EU. This is a fundamental rule of EU VAT law.

Have You Reported This to Stripe?

Yes, we have. We’ve had an extended and frustrating exchange with Stripe’s support team over the course of three months. We tried to explain how VAT regulations work in the EU, emphasizing that VAT should never be added when invoicing or sending payment links to customers outside the EU.

As a business management and accounting platform with a team of over 20 experienced accountants and direct access to tax office consultations, we are confident in our understanding of Estonian and European VAT laws. Unfortunately, despite our efforts, Stripe has refused to acknowledge the problem. They claim that VAT is added or omitted based on the product or service being sold, which is incorrect in the case of a non-EU customer. If the customer is outside the EU, VAT should never be applied to the invoice, regardless of the product or service.

Due to this ongoing issue, we have no choice but to strongly advise our customers not to use Stripe’s Payment Links tool for payment requests.

What Could Happen If You Use Stripe’s Payment Links?

Adding VAT to a non-EU customer’s invoice is a violation of tax regulations. In the best-case scenario, our system or our accountants will catch the error and ask you to either refund the VAT or reissue the invoice without it. This will likely cause confusion and inconvenience for your customer, who would have overpaid due to the incorrect VAT charge.

In the worst-case scenario, if the mistake goes unnoticed, VAT could end up being added to your accounting books for a non-EU customer. This could lead to trouble with the Estonian tax authorities later on.

To recap: VAT is only applicable within the EU. If your business is VAT-liable, you may need to add VAT for sales to EU customers. VAT collected from EU customers is distributed by the government, often through the OSS scheme. However, collecting VAT from non-EU customers, or failing to collect it from EU customers when required, is something you want to avoid.

What Are the Alternatives?

Your options will depend on your business model.

- For SaaS businesses: It’s often better to integrate Stripe’s API into your system and manually configure VAT at your end. This gives you full control over how VAT is applied, ensuring compliance. We offer a comprehensive FAQ that explains when and how to apply VAT depending on the services or products your business offers.

- For service-based businesses with manual invoicing: If you don’t have a high volume of invoices, you may not need Stripe for payment collection. You could consider asking your customers to pay via wire transfer or explore other alternatives like Revolut Payments or Payoneer, which are compliant with EU VAT regulations.

Summary

At Companio, we care deeply about ensuring our customers’ compliance and success. While Stripe is a reliable platform for many payment-related tasks, we strongly recommend avoiding its Payment Links tool. The tool’s inability to handle VAT properly could cause significant issues for your business, from incorrect invoicing to potential trouble with tax authorities.

By staying informed and using the right tools for your business model, you can avoid these pitfalls and ensure your business remains compliant.

Ignacio Nieto

Ignacio Nieto