Estonia’s Tax Changes: Impact on Digital Businesses and How Companio Can Help

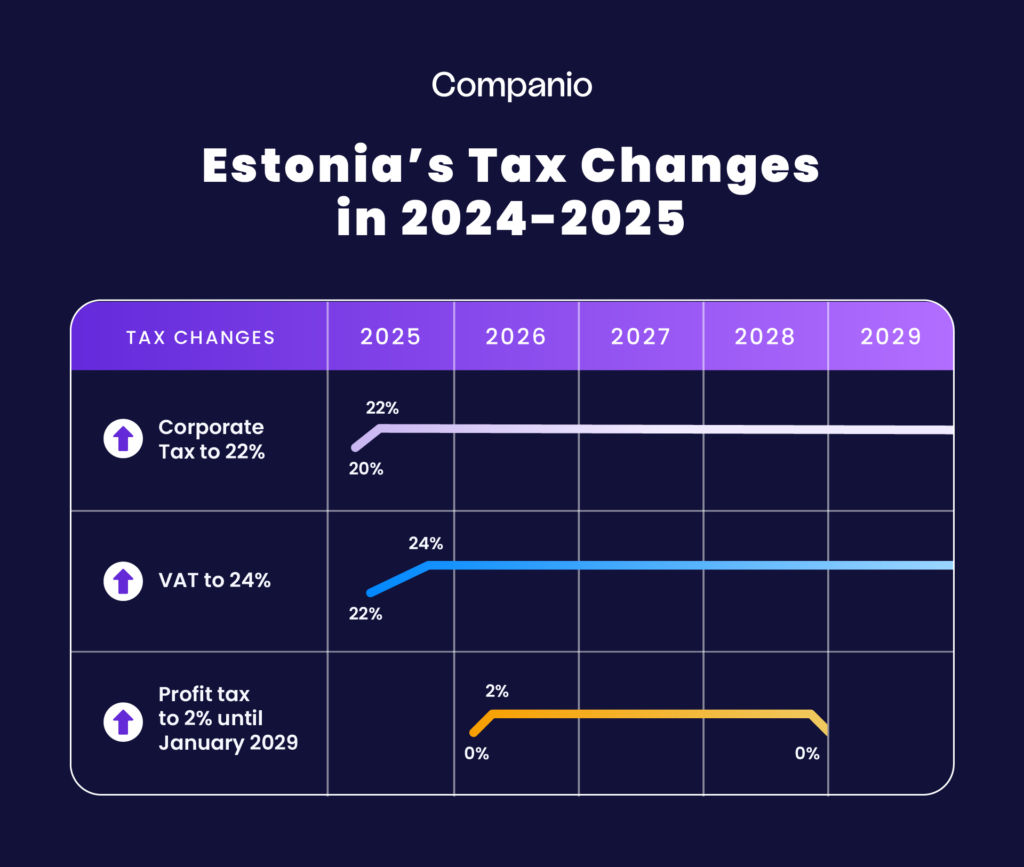

In 2025, Estonia implemented significant tax and regulatory updates that may impact digital businesses operating remotely through the e-Residency program. This article highlights the Estonian tax changes for 2025 and beyond, detailing how they affect digital entrepreneurs and how Companio can help you navigate this evolving landscape with ease.

Estonia Tax Changes 2025:

1. Corporate Income Tax Increase on Distributed Profits (Effective since January 2025)

What’s Changing: In January 2025, the corporate income tax (CIT) on distributed profits increased to 22%. Estonia’s unique system of taxing only distributed profits remains. However, this rate hike will affect companies planning to distribute significant profits through dividends. Example: If you plan on distributing 100,000€, with the previous tax rate of 20% gross, your business will pay 25,000€ in taxes (20% of 100,000 + 25,000€). Nonetheless, after this increase, distributing the same amount of dividends would require your business to pay 28,205€ (3,205€ more).

Impact on Digital Businesses: Digital businesses that rely on profit distribution, especially those planning substantial dividend payouts, will face higher taxes. This change is particularly relevant for entrepreneurs who count on dividend distributions for personal income.

Companio’s Advice: Companio can help optimize your profit distribution strategy to make the most of Estonia’s tax framework. Our advisors provide guidance on timing distributions or reinvesting profits. This will help you reduce tax liability and maximize the benefits of Estonia’s business-friendly system.

2. VAT in Estonia Increase to 24% (Effective since July 2025)

What Changed: In July 2025, VAT in Estonia increased from 22% to 24%. This adjustment continues Estonia’s alignment with broader European trends to increase VAT rates. Impacting businesses that sell products or services within the EU.

Impact on Digital Businesses: For digital businesses serving EU clients, this VAT hike will require adjustments to pricing strategies to accommodate the increased rate. Companies with primarily non-EU clients may not feel a direct impact. On the other hand, it’s essential for digital entrepreneurs who provide services or goods within the EU to plan accordingly.

Companio’s Advice: Companio’s VAT tracking tools will automatically apply the new rate, ensuring accurate invoicing and compliance without added complexity. Our platform simplifies financial management, allowing you to adjust prices as needed and stay focused on growing your business.

Key Tax and Regulatory Changes in 2026

3. Security Tax on Corporate Profits (Effective January 2026)

What’s Changing: From January 2026, Estonia will introduce a 2% security tax on corporate profits, calculated based on the previous fiscal year’s profits before income tax. This tax will be paid quarterly in advance and is planned to last until December 31, 2028.

Impact on Digital Businesses: The security tax adds a new layer of financial planning for companies with taxable profits in Estonia. This change could be especially relevant for growing digital businesses with consistent profits, as it requires careful budgeting to accommodate quarterly advance payments.

Companio’s Advice: Companio’s financial planning tools help you account for this new tax in your forecasts, giving you a clear view of future obligations. Our team is ready to assist you in integrating this tax into your business strategy, ensuring you are prepared well in advance.

This is How the New Security Tax will Work in Estonia

The security tax will be paid on profits (income – expenses) and we give you this example to explain how it works:

The company “Business OÜ” will have these profits at the end of 2026 (the year in which the security tax comes into effect):

- Q1: €30,000 (ex: €100,000 revenue, €70,000 expenses)

- Q2: €20,000

- Q3: €10,000

- Q4: €40,000

At the end of the year they decide to distribute €10,000 in dividends (in this example we also apply the increase mentioned in point 1 on the tax on distributed profits by 22% or 22/78).

“Business OÜ” would have to pay the following:

- Q1: €600 in security tax (2% of €30,000)

- Q2: €400 in security tax

- Q3: €200 in security tax

- Q4: €800 in security tax

After the annual report and distributing dividends: €2,820.51 in CIT.

In reality, this new security tax does not represent a very significant change, and will also be in force only from January 2026 – to December 31, 2028.

How Companio Supports Digital Businesses Through These Changes

Companio is committed to helping digital entrepreneurs stay compliant and financially efficient as Estonia’s tax landscape evolves. Here’s how our solutions can assist you in adapting to these 2025 tax changes:

- Automated VAT and Tax Management: Companio’s platform automatically updates VAT, corporate income tax, and personal income tax rates. Ensuring seamless compliance for your business.

- Profit Distribution Planning: Our expert advisors provide guidance on optimizing dividend distributions. Always helping you balance tax obligations with profit reinvestment strategies.

- Advanced Financial Planning for New Taxes: With the upcoming security tax, Companio offers financial planning tools and insights to help you budget effectively. Making it easier to adapt to quarterly advance payments.

- Personal Income Tax Support: Companio’s payroll services manage personal income taxes for e-residents. Simplifying the process of adapting to new tax rates and maintaining compliance.

Tips for Digital Entrepreneurs to Prepare

- Review Your Pricing Strategy for VAT Changes: Ensure that pricing for EU clients reflects the VAT increase to 24% for a smooth transition in July 2025.

- Plan Dividend Distributions Carefully: Work with Companio’s advisors to optimize your profit distribution strategy under the new corporate income tax rate.

- Budget for the Security Tax: Include the new security tax in your financial forecasts to ensure smooth quarterly payments from 2026 onwards.

- Adapt Personal Income Tax Strategies: If you declare personal income in Estonia, explore tax-efficient methods to manage the upcoming increase to 24%.

Is Estonia Still a Great Place for Business?

Estonia remains one of the most entrepreneur-friendly countries globally, offering a seamless. Fully online administrative process that brings unparalleled freedom and accessibility. Entrepreneurs can set up, manage, and grow their businesses entirely digitally. Eliminating the hassle of traditional and long processing times.

This low-bureaucracy approach fosters business operations, making everything from company registration to tax filings fast and efficient. Furthermore, with the upcoming digital advancements in e-Residency—soon enabling a completely cardless experience—Estonia is continuously evolving to support a future where managing a business remotely is not only possible but effortless.

These unique benefits keep Estonia at the forefront as an administrative paradise for modern entrepreneurs.

Final Thoughts

Estonia’s 2025 tax changes are part of an evolving fiscal landscape aimed at aligning with EU standards. While these updates introduce new considerations, digital businesses can still benefit from Estonia’s unique tax structure with careful planning and the right support. Notably, Estonia continues to rank at the top of the 2024 International Tax Competitiveness Index for its favorable and straightforward tax system. Still being considered as one of the most attractive environments for entrepreneurs worldwide.

Companio is here to provide the tools, advice, and automated solutions that make adapting to these changes straightforward and stress-free. By partnering with Companio, digital entrepreneurs can focus on scaling their businesses, knowing they are fully prepared for Estonia’s upcoming tax adjustments.