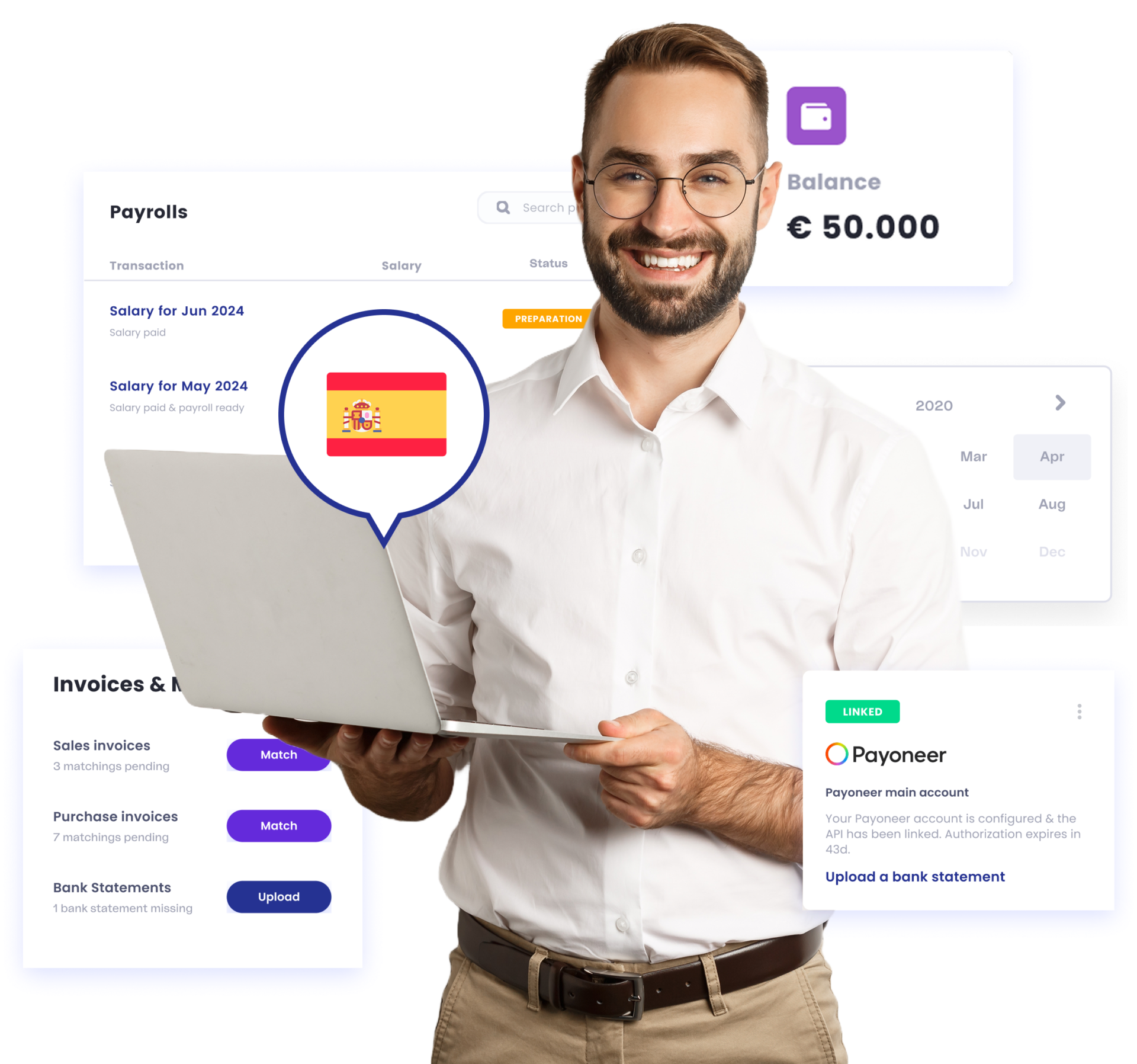

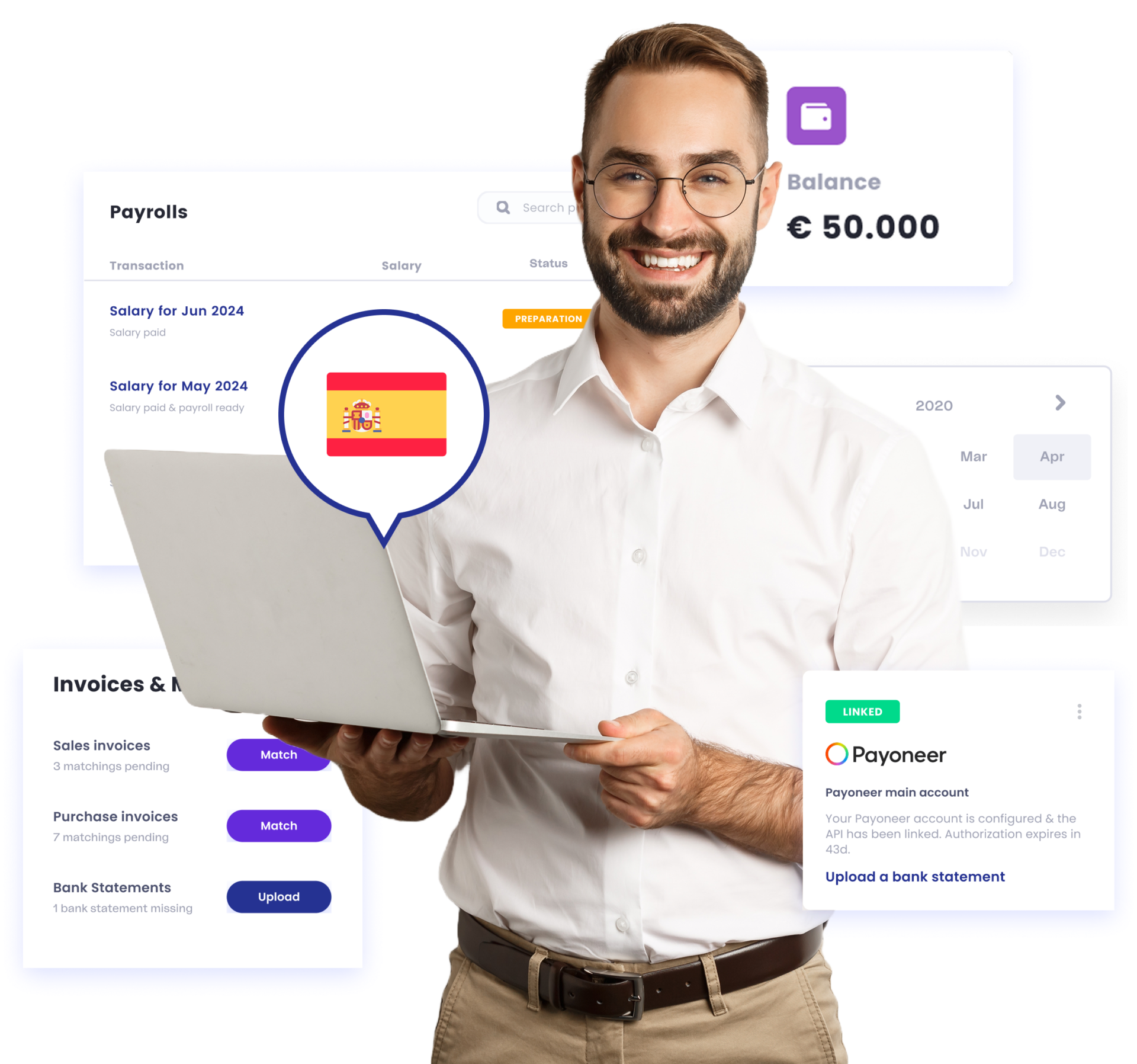

Accounting for "Autónomos" in Spain

Simplify your Spanish financial life with free "autónomo" registration and an integrated accounting dashboard—designed for freelancers and all self-employed professionals.

Simplify your Spanish financial life with free "autónomo" registration and an integrated accounting dashboard—designed for freelancers and all self-employed professionals.

20hours/month Saved on accounting

40%saved On administrative costs

<5minutes Time-to-Registration

100%compliant Quarterly and annually

When it comes to managing your freelancer ("autónomo") finances in Spain, our service stands apart with cutting-edge technology and personalized service. A setup designed to optimize your operations from day one.

If you're not registered as an "autónomo" in Spain yet, we’ll take care of it completely free of charge, so you can start right away.

Whether you operate locally in Spain or work remotely, manage your business from a centralized platform.

All-in-one accounting & compliance dashboard that simplifies your invoicing, bank reconciliation, tax filing (including VAT, IRPF, and all models), and more.

Stay up-to-date with Spanish regulation through quarterly and annual reporting. Our team of accountants personally handles every operation.

We handle all tax filings related to the "autónomo" regime in Spain: VAT (models 303 and 390), Spanish IRPF (models 130 and 115), and models 347 and 349.

Receive assistance every step of the way from our experienced team. If you need help, an expert will be available in seconds.

Our service is trusted by professionals who desire complete freedom and need a digital, streamlined solution to manage their online business.

Getting your freelance business organized in Spain is as simple as 1-2-3:

Sign-up in Minutes: Create your account with us in just a few clicks. Remember: if you're not an autónomo yet, we'll do it for free.

Link Your Bank: Connect your bank account—that's how we can reconcile your account movements with your bank statements.

Accounting Dashboard Integration: Gain immediate access to the all-in-one accounting dashboard to run your business from anywhere.

You must have all invoices within the platform before the 5th of the following month, and our experts will deliver your tax and fiscal reports to comply with Spanish regulations.

At the heart of our service is the powerful all-in-one accounting dashboard—your central hub for managing every aspect of your company’s financial health.

Intuitive Management

Intuitive Management  We automate processes to give you more freedom: an easier and faster way to manage your finances.

We automate processes to give you more freedom: an easier and faster way to manage your finances.  User-friendly Interface

User-friendly Interface  Simplified accounting, with an interface that’s easy to navigate. Our dashboard presents clear visual insights and provides immediate access to essential data.

Simplified accounting, with an interface that’s easy to navigate. Our dashboard presents clear visual insights and provides immediate access to essential data.  Cutting-edge Technology

Cutting-edge Technology  Our innovative approach disrupts outdated accounting practices. Forget about traditional accounting!

Our innovative approach disrupts outdated accounting practices. Forget about traditional accounting!  Comprehensive Financial Control

Comprehensive Financial Control  This tool centralizes all your financial operations: from global invoicing, to multi-currency transactions and automated bank reconciliation.

This tool centralizes all your financial operations: from global invoicing, to multi-currency transactions and automated bank reconciliation.

Reserve a 30-minute personalized consulting session with one of our experts for €99 + VAT.

We’ll clear up all your doubts about business feasibility, fiscal advantages, tax compliance, and whatever causes you uncertainty.

We know navigating Spain’s tax system as a freelancer can be overwhelming. Join countless "autónomos" who have streamlined their accounting and focus on your professional pursuits.

If you already are a freelancer ("autónomo") in Spain, you can switch to us from another provider completely free of charge. Minimum commitment period of three months. (*)

This service supports business activities that are online, digital, professional, or can be performed in a location independent way. The crucial point is that this activity can be carried out regardless of your country of residence or physical location.

This includes sectors such as software development, digital marketing, design, consulting, online education, legal services, translation, and copywriting. It is also ideal for tech startups, dropshipping businesses, and e-commerce stores operating exclusively online. Read more.

Companio takes care of all the tax reports and filings that freelancers in Spain are required to submit. This includes VAT (models 303 and 390), personal income tax filings (models 130 and 115), and models 347 and 349. We make sure your tax obligations are always handled accurately and on time.

If you switch to Companio from another provider, there is a minimum commitment period of three months. For more information, please see our Terms and Conditions.

You only need to connect your bank accounts and upload the invoices issued during the previous month before the 5th.

We will also provide you with a personalized email address where your suppliers can send their invoices directly to your management panel.