Why Proper Invoicing Is Important for OSS and Dropshipping Businesses

If you have a dropshipping business or offer digital downloads or automated services, you may not be aware of the importance of properly invoicing your customers. Some businesses decide to delegate their invoicing to their payment gateway, while others ignore invoicing altogether, and just hand us a statement from their payment gateway when it’s time to do the accounting.

Even though we understand it’s not fun, properly invoicing your clients is truly important for your company. If you are delegating it to your payment gateway (or even worse, not doing it at all), you are not only losing money but risk being fined by the tax authorities… or worse.

If your provider is ok with this practice, you should be concerned. Really concerned. In this article, we explain why proper invoicing is important for OSS and dropshipping businesses.

Table of contents

What Should Be Included in an Invoice?

When you offer a service or sell a product, you need to issue invoices to your customers. Even if they don’t want them, even if they don’t ask for them. They are essential for the proper bookkeeping of your company.

When invoicing individuals, your invoice must include the name and address of the customer. This is not a whim. The name allows the authorities to identify the customer, and the address allows them to understand where the service or product was offered. As we’ll see later, this is critical for OSS businesses and dropshipping online shops.

An invoice should also include a unique invoice number, the data of the issuer (i.e: your company), the issue date, due date, and the information about the goods or services being served to the customer, including the base price, % of VAT applicable, and total cost including that VAT.

How VAT Works for OSS and Dropshipping Companies

When your company is in the OSS scheme (because you are a dropshipping business or offer digital downloads or streaming services), the sales of your services and products are considered to happen in the country of the customer.

In other words, if a French person buys a T-Shirt from your online shop, even if your Estonian company orders a Chinese provider to send the tee to the French customer, the sale is not happening in Estonia or in China. It is happening in France.

That means the applicable VAT is the VAT of the country of your customer. If your customer is outside of Europe, no VAT applies. In our previous example, the French VAT (20%) should be applied to the invoice.

Under the OSS scheme, you won’t need to declare this VAT to the French authorities, though. You pay all the VAT to Estonia, and specify how much VAT was collected in each country.

The Estonian tax office will distribute it to different countries every quarter after your OSS report. Your business service provider can take care of that. In Companio, that report is included for free for all our dropshipping and OSS customers.

Why Is It So Important to Get VAT Right?

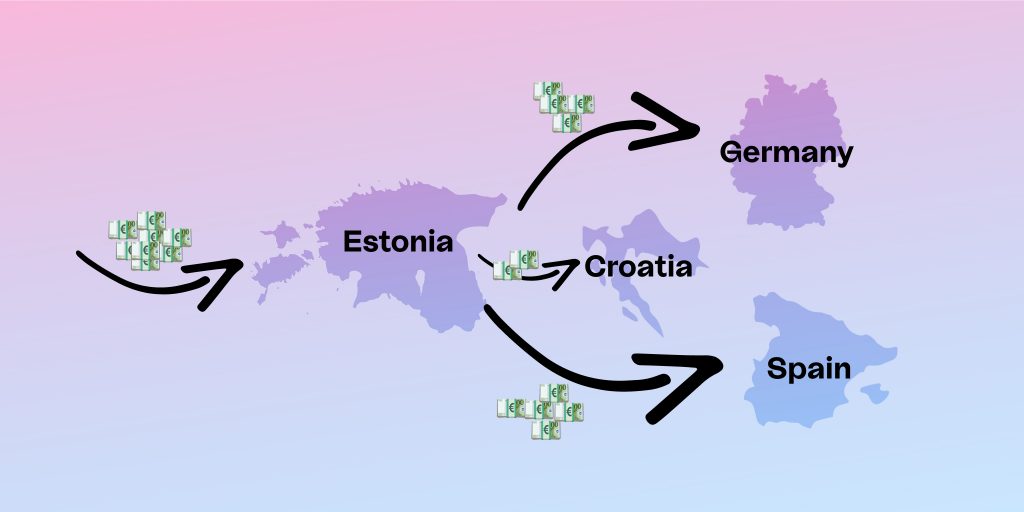

This is not just a matter of charging 1-2% more or less in the invoice. The VAT that you collect from a French customer belongs to France. The VAT that you collect from a Croatian customer belongs to Croatia. You need to pay that VAT to the right country.

Not doing so may get you in trouble first, with the local Estonian authorities (as you are not declaring VAT correctly) and, second, with the tax authorities of different European countries (as you are collecting taxes from their citizens and giving that tax to other nations).

It can be a mess if you do it wrong.

Relying on Your Payment Gateway for the Invoicing?

We get it. Invoicing requires extra work from you. You must prepare your online shop or website, ask your customers for their addresses, and make sure the system generates the invoices correctly. You just want to set up WooCommerce, Prestashop, or Shopify, upload the items, and start earning money as fast as possible.

You may not want to deal with that VAT stuff. It’s difficult to understand, and you need to install a module on your online shop to deal with it. Perhaps you don’t want to make your products look more expensive for your European customers by adding VAT.

Some businesses may decide to leave invoicing to their payment gateway, so it automatically generates the invoices for them. They may not even generate the invoices at all. Let’s see why that does not work.

Imagine that you get something like this from your payment gateway (let’s say, a Stripe’s transaction statement, for example):

| Customer ID | Product | Cost | Fee | Tax | Card name | Card last 4 digits | Card country | Customer email |

| id_123456789 | Video course: gluten-free cuisine | 100.00 | 2.91 | 0.00 | John Smith | 4242 | LT | john.smith@email.com |

| … | … | … | … | … | … | … | … | … |

If you just send us (or any service provider or accounting firm) this information only, there is no way we can know with certainty what the invoice for John Smith should look like. Stripe (like most payment gateways) only gives you information about the card that was used for the purchase, the total cost, the email of the customer, and some fees. They usually don’t include the right VAT or tax in the invoice, or take into account the nature of the product or service being sold.

We may guess, but bookkeeping is not about guessing, it’s about knowing.

So you may ask: “Can’t you just say, ok, this John Smith seems to be in Lithuania, and the VAT of Lithuania is 21%, so you assume that the base cost is 82.65€, with a VAT of 21%, that’s 100€. Just do these calculations for every customer in the statement and we’re done!”.

Why Proper Invoicing Is Important for OSS and Dropshipping Businesses

Let’s see why that is a terrible idea, using the example described above.

You Are Losing Money

First and foremost, it’s important to understand that VAT stands for Value Added Tax. It is a tax that gets added to the value of a good or service. If your company always charges 100€ for a product, and you never add VAT to it, the real cost of the good or service varies from country to country. In a country where VAT needs to be added (for example, Lithuania), the VAT will be considered as included in the price.

That means that instead of charging 121€ to a Lithuanian customer (100€+21% VAT), you are charging 100€, of which 82.65€ is your revenue, and 17.35€ is VAT. In short, you are earning just 82.65€ for that sale, the rest is VAT that you need to pay.

You may be ok with that, but it is something you need to be aware of. Also, you need to understand the implications for your business model. Your product is much cheaper for some European customers, and if your profit margin is narrow, you may even lose money in some countries (Hungary has a 27% VAT, how much is your profit margin?).

Your Customers May Not Live In the Country of Their Credit Cards

Stripe, Mollie, and other payment gateways don’t give you information about the country where your customer is. They give you information about the country of the bank that issued the card that your customer is using to pay. That difference is important.

Do you use Revolut Business or Paysera? A lot of people do. These online banking solutions will give you bank accounts in different countries (like Lithuania or Belgium) that may not necessarily match your country of residence. Even if your customer is using a traditional bank, they may now live in a completely different country.

You cannot assume that the country of the bank that issued the card used for the payment is the same country where your customer is located when purchasing your services or products.

In the example above, that customer may be paying with a card from a Lithuanian bank (perhaps Revolut, which uses a Lithuanian bank), but the customer can be in France, Italy, or even outside of Europe. That will also be a very problematic situation: you are charging Lithuanian VAT to a customer that is not even in Europe (so no VAT should be added to the invoice).

Your Customers May Be Corporate Clients With VAT Numbers

The statements from payment gateways also don’t differentiate between companies and individuals. When invoicing a European company with a VAT number, your company should add 0% VAT to the invoice. In the example above, if John Smith is paying for a service with a corporate account on behalf of his company, it is wrong to charge him VAT.

Your Customers May Be In VAT-Exemption Areas in the EU

Even if we (falsely) assume that the cards of your customers are always issued in their home countries, there are zones in Europe that are exempt from VAT or where VAT rules don’t apply. One example is the Canary Islands in Spain. If you are invoicing a customer from the Canary Islands, even if the customer lives in Spain, you cannot add Spanish VAT to that invoice.

You can check the whole list of VAT-exempt areas here. Fortunately, most invoicing software plugins nowadays take this information into consideration.

Collecting VAT when you shouldn’t, or not collecting VAT when you should is serious business. It can get you into trouble with the Estonian authorities and the tax offices of other countries.

You May Will Have Problems With the Tax Office

If you take your business seriously, you want to see it grow and thrive. Entrepreneurship is hard enough without adding more uncertainty needlessly. Eventually, most companies go through audits from the tax office.

If your company does not have invoices, or these are incorrect, you may be subject to fines or even run into legal trouble. You don’t want that. We, as service providers, don’t want that either.

Never Delegate Invoicing to Your Payment Gateway

Hopefully, by now, you understand that you can’t simply ignore invoicing or delegate it to your payment gateway. So what can you do?

The right thing to do is to add a module to your online shop or website that asks for the address of the customer during the checkout process, applies VAT accordingly, and generates the right invoice. Most e-commerce software solutions offer these plugins for free, including the VAT-exemption areas. Many of them are quite easy to configure and use.

You can then upload these invoices easily in Companio or even set an automatic email address where they are sent and added automatically to your sales invoices.

Even though it is your responsibility, if your business service provider is accepting these statements without asking for proper invoices, they are taking a big risk, and putting your business in jeopardy. If you go through an audit, and chances are, you eventually will, you can get into trouble.

Do your business a favor and invest a little time and effort in putting together a proper invoicing system. It’s time well spent.

Ignacio Nieto

Ignacio Nieto