Travel Agency Companies in Estonia

An Estonian company acting as a tour agency needs to apply for a specific tour-agent license before being able to start its activity. This license has an extra cost, not included in the company registration price. It must also deposit a variable amount of money as a guarantee fund depending on the exact tour-agency services offered by the company.

If your company is not offering the tours itself but is essentially a reseller of other(s) tour operator(s), you don’t need a license, and there is a special VAT scheme applied to your company.

For tour agencies and tour operators, this security or guarantee deposit depends on the type of trips you are offering, according to this classification.

As an example: if you offer packages that include travel services offered outside Estonia and charter flights, you would enter section 6. (2), and therefore your warranty or insurance should adhere to what’s specified in section 151. (1), which implies 7% of your annual income or 32,000 euros, whichever is greater.

Here you can access the official Estonian document with all the information.

Can Tour Agencies Resell Packages from Other Operators or Agencies?

If you are not a travel agency, but an intermediate company reselling tours from other tour agencies or tour operators, you don’t need to obtain a license before your company starts its activity.

However, you need to choose which VAT scheme applies to you:

If the Estonian company resells the travel services from another reseller or travel services provider (i.e: a tour operator), the Estonian company has a choice: to use ordinary VAT rules or to apply the travel agents’ margin scheme also in such case (even if you resell the travel services to another reseller, not to the final consumer). And it’s not important, is the next reseller the other Estonian company, a company from the other EU Member State or from a non-EU country.

In the first case, the Estonian company must register for VAT liability in the EU Member States where the travel services are actually provided. The company will also need to submit VAT and pay its corresponding taxes in these EU Member states.

If the Estonian company chooses the margin scheme and the travel services are actually provided in any other EU Member State, VAT will be taxable in Estonia with the Estonian standard VAT rate of 20%(22% from January 2024), but only the margin is taxed with VAT, not the total sales price of the travel services. Because of that, it’s usually better for such an Estonian company to apply the margin scheme, to avoid possible VAT obligations in foreign countries.

However, there are some important considerations of being into the special margin scheme to take into account:

-

- Purchase VAT of hotels, restaurants, transportation, or other travel services provided in Estonia is not deductible. Foreign VAT of hotel and restaurant services, provided in the other EU Member State (not in Estonia) can’t also be refunded through the VAT Refund scheme.

- If the hotel, restaurant, transportation, or other travel services are purchased in other EU Member State, the Estonian company who uses the margin scheme must not tax these services through a reverse charge system and must not declare intra-Community acquisition of services in the VAT return.

- If the hotel, restaurant, transportation, or other travel services are purchased in a Non-EU Member State, the Estonian company that uses the margin scheme must not tax these services through a reverse charge system and must not declare services in the VAT return.

- For these companies, the turnover is based on agency fees or commissions. Services are not provided in Estonia and should be reported as export of services with 0% VAT. To report them correctly the invoices need to include two concepts clearly separated:

- The cost of the services provided by the travel service provider (i.e: the tour agency or operator).

- The fee or commission of the Estonian company (indicated as commission or fee).

The income of the Estonian company is only the commission.

Let’s see two specific examples. First, an example where the services are sold outside of Europe.

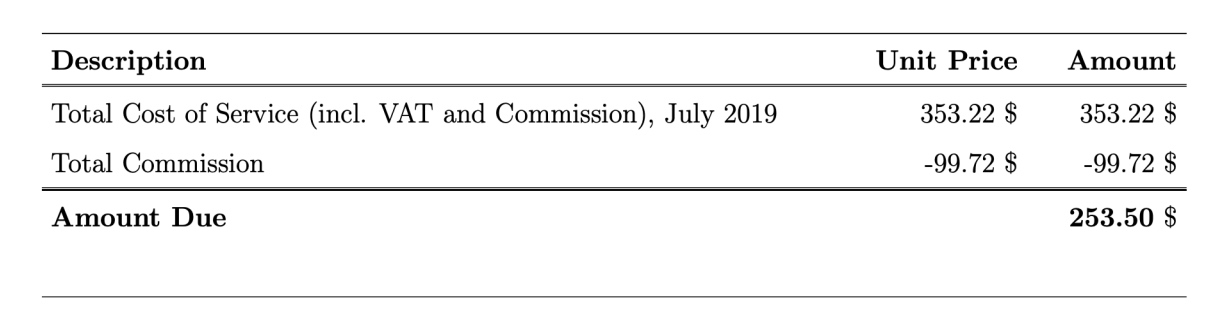

Below you can see an invoice where the two concepts we mentioned are clearly indicated. It’s also necessary that the invoice includes the name of the company actually providing the travel services.

In this example, the turnover and income of the Estonian company will be 99.72 USD and will be reported as an export of services subject to a 0% VAT rate.

In this example, the turnover and income of the Estonian company will be 99.72 USD and will be reported as an export of services subject to a 0% VAT rate. - If your Estonian company works with clients from the EU Member States (including Estonia) the situation will be less beneficial because the company should pay 20%(22% from January 2024) of all commissions.

So as an example, let’s suppose we have the previous invoice, but this time the services are sold to Germany.

In this case, the turnover and income of the company is 99.72 USD, including a 20%(22% from January 2024) tax that needs to be paid to the Estonian Tax Board. In numbers:

Turnover 99.72/1.2= 83.10 USD

VAT to be paid 83.10*0.2= 16.62 USD

Total: 83.10 USD + 16.62 USD = 99.72 USD - If the company is not VAT liable, or before it needs to become VAT liable, the same rules apply for its income, but this time, there will be no VAT applied to the fees. All of it will be income.

The actual English text of the Estonian VAT Act is available here. The rules of taxation of the travel services are established in Article 40.

Still have doubts? Let us help! Companio provides thousands of clients with high-quality accountancy services and trustworthy advice regarding your company in Estonia. You can contact us via chat.

Ignacio Nieto

Ignacio Nieto In this example, the turnover and income of the Estonian company will be 99.72 USD and will be reported as an export of services subject to a 0% VAT rate.

In this example, the turnover and income of the Estonian company will be 99.72 USD and will be reported as an export of services subject to a 0% VAT rate.