Business Incorporation & Accounting in Ireland

Manage your Irish company through our all-in-one accounting platform—enjoy everything you need to grow in one of Europe’s most business-friendly countries.

Manage your Irish company through our all-in-one accounting platform—enjoy everything you need to grow in one of Europe’s most business-friendly countries.

Ireland is a trusted EU gateway with low corporate tax, strong legal protections, and a thriving global business ecosystem. Companio helps you incorporate and stay compliant with expert accounting support and a fully digital experience.

For a single fixed fee, we connect you with regulated partners who handle the entire setup process, including the first year of company secretarial services.

Launch your company with Companio in a stable EU economy with full access to European markets, banking, and trade benefits.

Ireland’s 12.5% corporate tax rate makes it ideal for profitable businesses distributing dividends globally with tax efficiency.

Take advantage of 78 tax treaties with emerging and developed markets—including Brazil, South Africa, and Hong Kong.

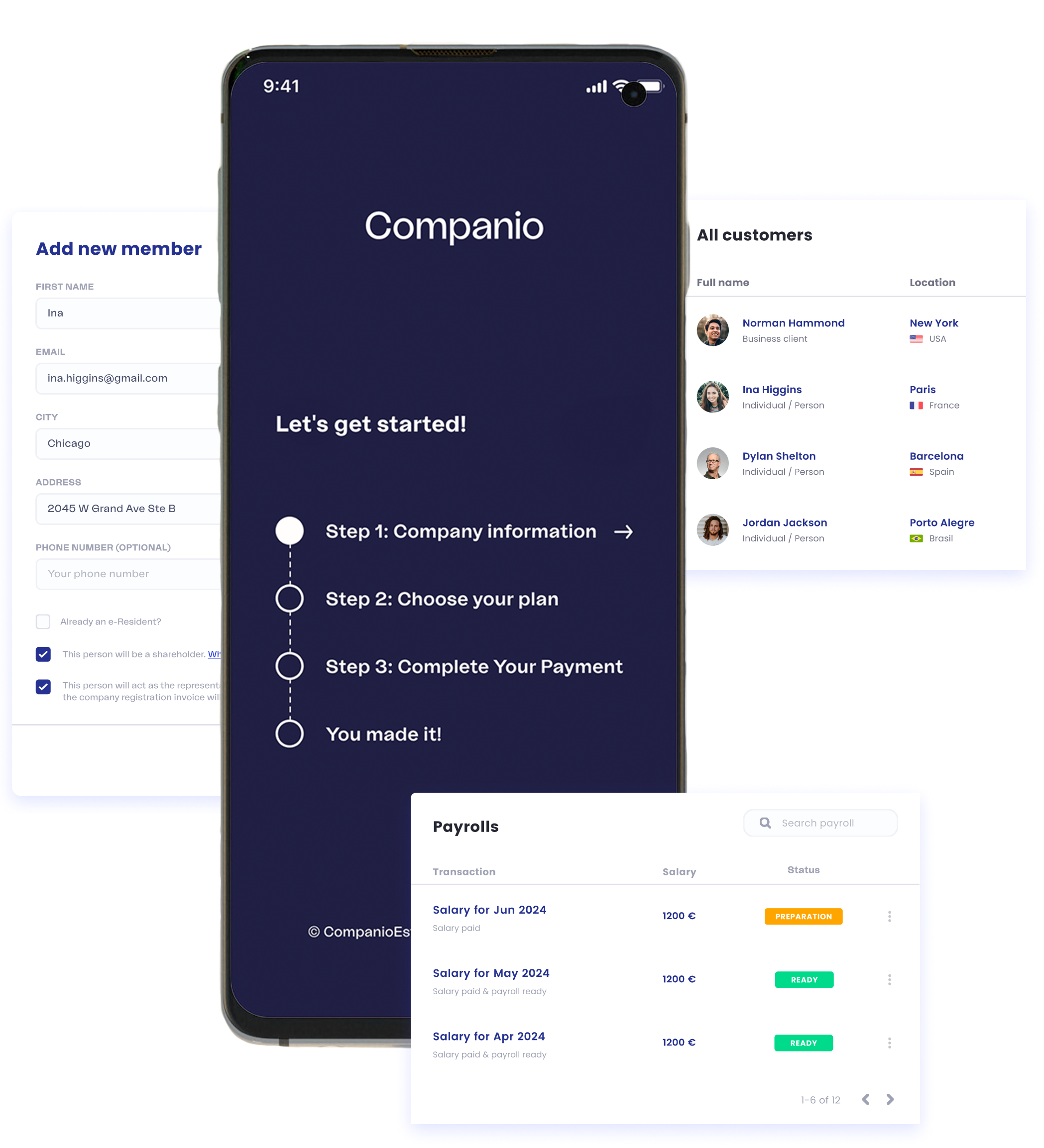

Our all-in-one dashboard handles invoicing, bank reconciliation, tax filing, and reporting—fully compliant with Irish law.

Get responsive, personalized support from professionals experienced in Irish company law, tax, and EU compliance.

Whether you’re launching a tech startup, managing a consultancy, or expanding a global operation, Ireland offers the tools and trustworthiness to scale with confidence.

Getting your Irish business up and running is as easy as 1-2-3:

Sign-up in Minutes: Complete our online form, choose a name, and you're done!

Activate Your Company: Complete our simple five-step process to activate your Irish company, often within days.

Accounting Dashboard Integration: Connect your bank account and gain immediate access to our accounting dashboard to run your business from anywhere.

You must have all invoices within the platform before the 5th of the following month. Then, our experts will deliver a monthly reporting package including VAT, tax and compliance.

At the heart of our service is the powerful all-in-one accounting dashboard—your central hub for managing every aspect of your company’s financial health.

Intuitive Management

Intuitive Management  We automate processes to give you more freedom: an easier and faster way to manage your finances.

We automate processes to give you more freedom: an easier and faster way to manage your finances.  User-friendly Interface

User-friendly Interface  Simplified accounting, with an interface that’s easy to navigate. Our dashboard presents clear visual insights and provides immediate access to essential data.

Simplified accounting, with an interface that’s easy to navigate. Our dashboard presents clear visual insights and provides immediate access to essential data.  Cutting-edge Technology

Cutting-edge Technology  Our innovative approach disrupts outdated accounting practices. Forget about traditional accounting!

Our innovative approach disrupts outdated accounting practices. Forget about traditional accounting!  Comprehensive Financial Control

Comprehensive Financial Control  This tool centralizes all your financial operations: from global invoicing, to multi-currency transactions and automated bank reconciliation.

This tool centralizes all your financial operations: from global invoicing, to multi-currency transactions and automated bank reconciliation.

Reserve a 30-minute personalized consulting session with one of our experts for €99 + VAT.

We’ll clear up all your doubts about business feasibility, fiscal advantages, tax compliance, and whatever causes you uncertainty.

Join countless entrepreneurs who have streamlined their accounting and compliance with Companio, and grow your business from one of Europe’s most trusted jurisdictions.

If you already have your business in Ireland, you can switch to us completely free of charge. Minimum commitment period of three months. (*)

We support digital, location-independent freelancers and businesses of all kinds.

Whether you’re a solo entrepreneur or have multiple shareholders, we can connect you with authorised partners to establish your company in Ireland, and help you with its accounting — from LTDs (Private Companies Limited by Shares), the most common choice for startups and SMEs, to Sole Traders, DACs (Designated Activity Companies), and other eligible legal structures such as CLGs (Companies Limited by Guarantee) and partnerships.

Our service is ideal for digital activities such as SaaS, e-commerce, online consulting, marketing, software development... Your business must be fully digital and have no physical presence or permanent establishment outside Ireland.

You don’t need to live in Ireland or the EU to open an Irish company. However, Irish law requires that at least one director be a resident of a country in the European Economic Area (EEA), which includes EU member states plus Iceland, Liechtenstein, and Norway.

If none of your company’s directors are EEA residents, you’ll need to purchase a Section 137 bond – a type of insurance required by the Irish Companies Registration Office (CRO). This bond typically costs between €1,800 and €2,500 and is valid for two years. It does not replace your legal obligations but allows you to incorporate the company without an EEA-resident director.

If you switch to Companio from another provider, there is a minimum commitment period of three months. For more information, please see our Terms and Conditions.

Once your company’s been activated, we will start working on your accounting, taxes, and compliance. On the 25th of the following month, we will charge you for the first monthly fee (the fee is charged when we complete the monthly accounting, which always happens on the following month, so your September accounting fee is charged on the 25th of October).